One of Amazon's biggest bulls explains four risks that could cause the 'demise' of the company

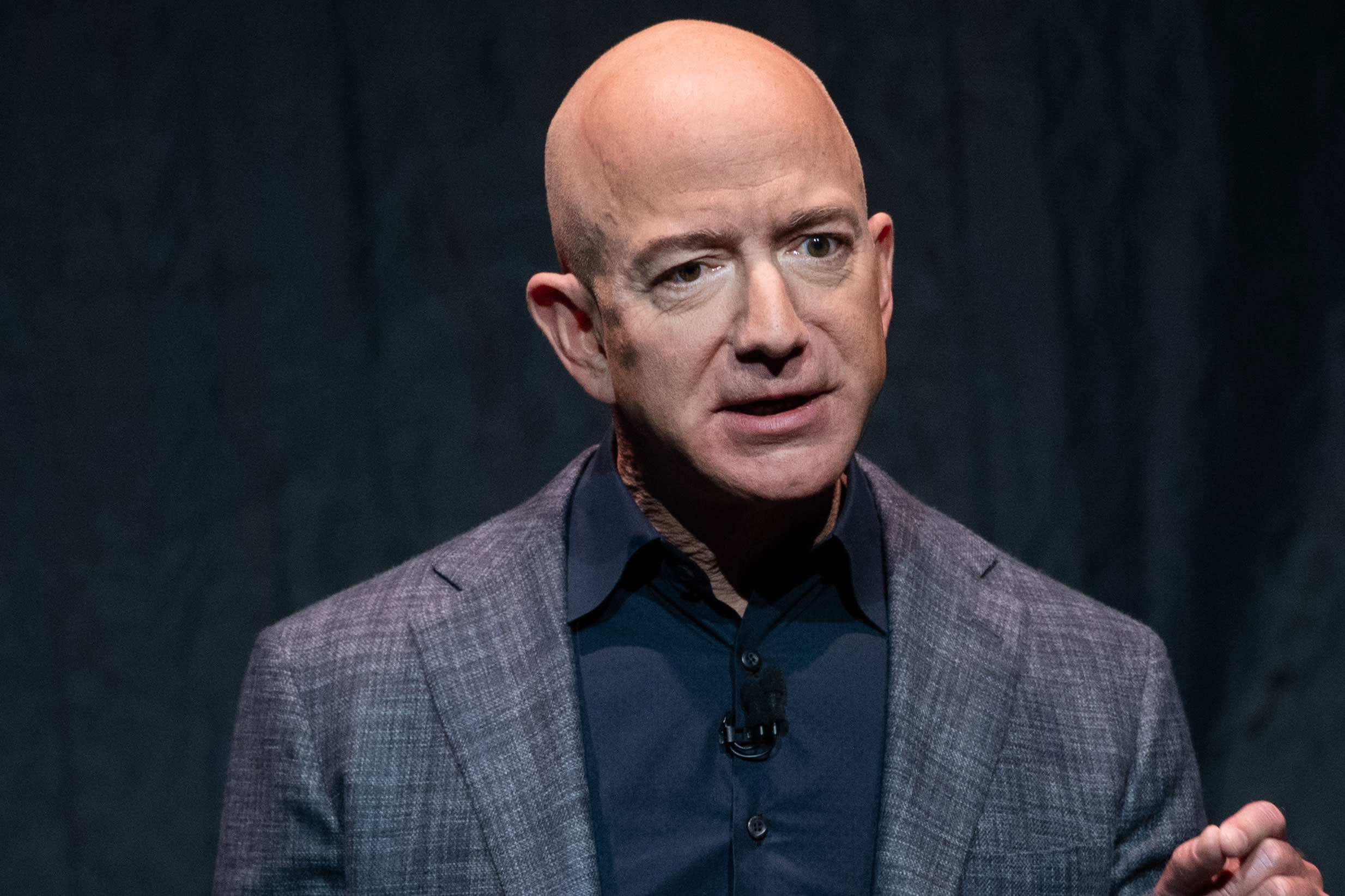

Amazon CEO Jeff Bezos announces Blue Moon, a lunar landing vehicle for the Moon, during a Blue Origin event in Washington, DC, May 9, 2019.

Saul Loeb | AFP | Getty Images

Wall Street loves Amazon, and investors have bumped its stock up another 20% this year.

But one of its most bullish analysts warns there are several looming risk factors facing the company now.

D.A. Davidson's Tom Forte, who has one of the highest target prices for Amazon at $2,550 per share, according to FactSet, wrote in a note published Thursday that he is closely monitoring four warning signs that could potentially result in the "demise of Amazon."

While Forte reiterated a "buy" rating for Amazon, and kept his price target unchanged, he wrote that the following four risk factors could negatively affect Amazon's future performance:

- The law of large numbers: Amazon has become so big that it would become harder to impress investors with rapid growth rates. For example, Amazon needs a whopping $2.3 billion of additional sales just to generate 1% growth, based on last year's total revenue of $232 billion, Forte noted. As a result, Forte expects Amazon's sales to increase at a 15.5% compound growth rate, down from the previous three years' 29.6% compound growth rate.

- Succession: What's going to happen when Amazon CEO Jeff Bezos decides to step down? It could lead to "significant succession risk," Forte notes, as the move to the next CEO could slow the overall business. At the same time, Forte notes that Amazon is well-prepared for the change, with a deep bench of executives who could potentially take the helm once Bezos leaves. Bezos, now 55, hasn't said much about his succession plan. For reference, Bill Gates was 45 when he left resigned as Microsoft CEO, while Starbucks' Howard Schultz and Walmart's Sam Walton both had much longer careers.

- Competition: Amazon will face intensifying competition in the its core e-commerce space, as most of the weaker players have already vanished. That means, in order to sustain its growth rate, Amazon will have to enter new, large markets, where more competition awaits, Forte writes. Two of the most challenging areas for Amazon going forward are apparel and grocery, Forte notes, as the company's has struggled to see much growth in either area. He believes Amazon needs more than just advanced technology to win categories like women's fashion, while noting the Whole Foods acquisition hasn't really moved the needle in winning share in the grocery category.

- Regulation: Forte notes that the U.S. government could "stop Amazon in its tracks" if it steps up antitrust or other regulatory scrutiny of the company. While Amazon's low price offerings could make an antitrust case challenging to pursue, Forte says the company's huge market influence could draw additional regulatory pressure, both in the U.S. and overseas. He wrote the potential for antitrust and regulation across the globe could "negatively impact Amazon's operating results and stunt its future growth."

Forte concludes that he still believes in the company, but is keeping a close watch for warning signs.

"As much as we hold Founder, Chairman, CEO, and President Jeff Bezos in the highest regard and as we are optimistic on the company's ability to sustain an elevated growth rate by further penetrating existing markets and entering new ones, and, therefore, a premium multiple for years to come, we are closely monitoring the company and stock for warning signs that could result in the demise of AMZN."

WATCH: Analyst explains why he says Amazon's stock will hit $3,000 in a few years

Read More

No comments